The U.S. Navy’s latest long-term shipbuilding plan lays out an aggressive path to achieving its long-standing goal of having 355 ships by 2034, two decades earlier than its last estimate. But this ambitious plan isn’t just about buying extra ships and the service says that when, and if, it reaches that total force size, it will cost $40 billion just to operate and maintain all of those vessels, more than thirty percent more than it spends on its fleets now.

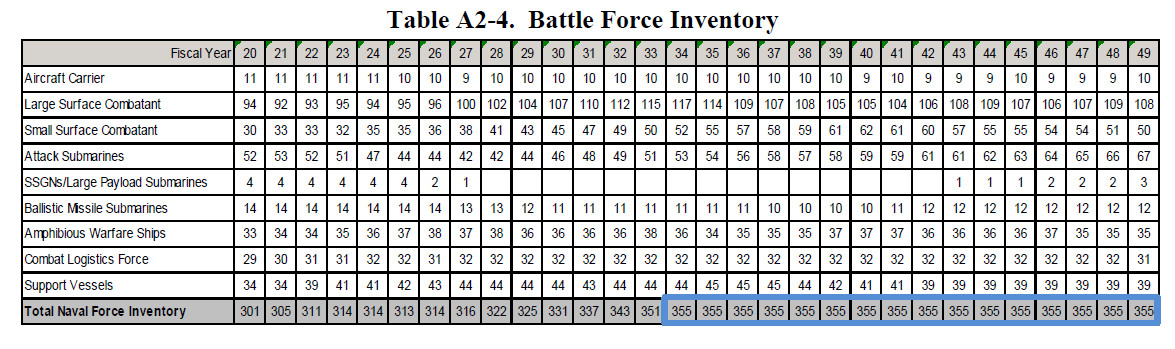

The Navy published the latest edition of what it calls its “Long-Range Plan for Construction of Naval Vessels,” on Mar. 21, 2019. It covers existing and planned procurement from Fiscal Year 2020 through Fiscal Year 2049. By the end of the 2020 fiscal cycle, the service expects to have 301 ships. The goal is to get that to the 355-ship target in Fiscal Year 2034, at which time the size of the overall force will hit a plateau.

“The timeframe for achieving the overall inventory [of 355 ships] was accelerated by approximately 20 years over last year’s plan,” the report explains. “Continual application of these imperatives, combined with Congressional support, on time funding, and strong industry response could yield additional opportunities for acceleration.”

The “principle driver” in this new timeline for getting to 355 ships was the Navy’s decision to extend the planned service life of its early Flight I and II Arleigh Burke-class destroyers from 35 to 45 years. The service has also previously talked about squeezing as many as 50 years out of later Flight IIA variants and the upcoming enhanced Flight III ships.

In addition, the Flight IIA ships are now set to receive a major radar upgrade in the coming years in the form of a variant of Raytheon’s AN/SPY-6 Air and Missile Defense (AMDR) radar. This radar is also going on the Flight III vessels and and is a core requirement for final design of the future Large Surface Combatant (LSC).

The video below describes how the AN/SPY-6(V)1 AMDR for the Flight III Arleigh Burke-class ships works and the benefits the new design offers.

The Navy plans to continue buying additional Flight III Arleigh Burkes through the 2025 Fiscal Year, after which it will shift to purchases of the forthcoming LSC. The service had planned to begin procuring the LSC, a ship still very much in the conceptual stage of development, in the 2023 fiscal cycle, but it confirmed it was pushing that start date back by two years earlier in March 2019.

The LSC is slated to eventually replace the Navy’s Ticonderoga-class cruisers and at least a portion of its Arleigh Burkes. With this in mind, the service plans to shift funds away from extending the life of the six oldest Ticonderogas, retiring those ships between 2021 and 2022 instead, in favor of other priorities, including the LSC program itself. The service will still modernize at least some of the remaining 16 cruisers, but the full shipbuilding schedule will now include a dip in the kind of capabilities these ships offer, which you can read about more here, due to the delay in the beginning of the LSC procurement.

The latest naval shipbuilding plan also includes major changes in plans for the Navy’s carrier fleets. The service now plans to buy two additional

Ford-class carriers in the 2020 Fiscal Year, instead of one. Whether this so-called “block buy” of the pair of flattops is actually a cost-effective measure has been the subject of debate, but the Navy insists it will save approximately $4 billion that can be spent elsewhere in the long term.

At the same time, the Navy is looking to cancel the planned major overhaul and refueling of the Nimitz-class aircraft carrier USS Harry S. Truman, again in order to redirect funding to support a “more lethal balance of high-end, survivable platforms … and complementary capabilities from emerging technologies.” This decision, and the details surrounding it, have been particularly curious, something The War Zone has already examined in major detail.

When it comes to the Navy’s surface fleets, it’s long-term planning also reflects plans to purchase at least 20 new frigates of yet to be selected design, referred to at present as FFG(X). Earlier in March 2019, the service issued a draft request for proposals laying out the purchase of an initial block of up to 10 ships beginning in 2020. This would mean the Navy would take delivery of the first ship by 2026 if everything keeps to that schedule, according to the contracting documents.

To further help meet its near-term goals, the Navy decided to defer purchases of two more San Antonio-class landing platform dock amphibious ships to some time after 2024. The service is also accelerating the retirement of its Avenger-class minesweepers in favor of a new mix of Littoral Combat Ships permanently equipped with a mine countermeasures mission module, additional mine countermeasures kits that can go on any available “vessels of opportunity,” mine-sweeping teams embarked on ships, and unmanned undersea vehicles.

The long-range shipbuilding plan also makes brief mention of the Navy’s significant push into unmanned surface vessels. However, the Navy has no plans as of yet to include any of these drone ships, even the 10 large displacement unmanned surface vessels it plans to buy in the coming years, which you can read about more here, in its overall ship totals.

“The mix of ships will be biased towards DDGs [Aleigh Burkes] until reaching individual inventory objectives across all ship types, a timeline principally driven by SSNs [attack submarines] and CVNs [carriers],” the new shipbuilding plan notes. “Numerically, SSNs remain the furthest from the inventory objective and options are being explored regarding expanding production.”

To help rectify this and keep up the pace for expanding its overall fleet size, the Navy is looking to purchase an extra Virginia-class attack submarine in the 2020 Fiscal Year. On top of that, there are now plans to refuel two Los Angles-class attack submarines to extend their services lives and the Navy has identified five more boats in this class that it could overhaul if desired.

The Navy does have a plan to develop and acquire an entirely new class of attack submarine, referred to as SSN(X), but this would contribute to the sustainment of a 355-ship fleet, rather than assisting in reaching that goal in the first place. The service doesn’t plan to receive any such submarines until around 2040.

Similarly, the near- and medium-term plans to begin purchasing the Columbia-class ballistic missile submarines, or SSBNs, and start replacing Ohio-class SSBNs, as well as ships in that class the Navy converted to guided missile submarines, or SSGNs, remains largely unchanged. The service is looking at possibly purchasing additional Columbias and a new Large Payload Submarine in the future, but again these would arrive after the total number of ships hits 355.

A Navy’s path to 355 ships gets rounded out thanks to a number of auxiliaries, one of the most notable of which will be the Common Hull Auxiliary Multi-Mission Platform (CHAMP). This program envisions a common, modular hullform that can serve as the basis for a fleet of vessels to take over for aging ships filling five diverse mission sets: sealift, aviation logistics support, hospital, repair tender, and command and control.

The Navy expects to begin buying the first CHAMP sealift variant in 2025. The service has also already received authority from congress to begin buying used, foreign-made ships for sealift purposes to help rapidly meet demand. There’s already a looming crisis in the Navy’s Military Sealift Command both about total capacity and concerns about the survivability of its ships in a major, high-end conflict, which you can read about in more detail here.

But it remains to be seen whether the Navy can keep to this ambitious schedule. There are already numerous roadblocks that could crop up just in the discussions in Congress about the final defense budget for the 2020 Fiscal Year. An increasingly vocal bloc of lawmakers is already upset about the plans for the Truman‘s early retirement and is planning to do everything in their power to block that from happening. It looks as if legislators may be increasingly more amenable to retiring the six Ticonderogas, but they have soundly rejected those proposals in the past, too.

There are serious concerns about the state of the first-in-class USS Gerald R.Ford and whether those deficiencies may still filter down to subsequent carriers in that class, despite the Navy’s continued efforts to mitigate the problems. This latest long-term shipbuilding plan could cause a different carrier-related crisis in that there is not even an apparent attempt to meet the legal requirement to have 11 active flattops at any one time beyond Fiscal Year 2025. It’s fair to say that the service hasn’t really met this mandate in years, but there was always a plan going forward to work toward that goal.

Many of the surface ships the Navy expects to buy in the coming years are not yet well defined, either, which makes it hard to assess how realistic the purchase and delivery schedules might be. At the same time, the service’s major push toward acquiring unmanned surface vessels, especially large displacement types that might well qualify as “small surface combatants” for accounting purposes in the future, may help further bolster the Navy’s overall force size. Drone ships of all sizes will have significant impacts on the service’s overall concepts of operation and broad requirements going forward.

“The Navy will continue to move quickly to assess the resultant naval power delivered by these systems, moving forward based on demonstrated, evidence-based capability,” the shipbuilding report says. “Navy will continue to push aggressively to deliver these capabilities and evaluate progress, and will work closely with Congress as this develops.”

Submarines, which the Navy acknowledges are its biggest challenge in getting to 355 ships, also pose significant risks for the plan. The service has been trying to get shipbuilders to ramp up production, but in doing so has experienced increasing quality control issues. Once a model program for delivering on schedule, the construction of new Virginia-class submarines has become beset by delays.

There are fears that this will only get worse when the same yards begin building Columbia-class SSBNs, a class of boats that is both vital to national security, but that is already proving to be hugely expensive. The latest shipbuilding plan “captures the fiscal challenge of sustaining the shipbuilding plan while introducing serial production of the new Columbia-class,” according to the Navy. While true, it leaves little margin for any major potential future cost growth, which could have major impacts on the rest of the service’s long-term shipbuilding goals.

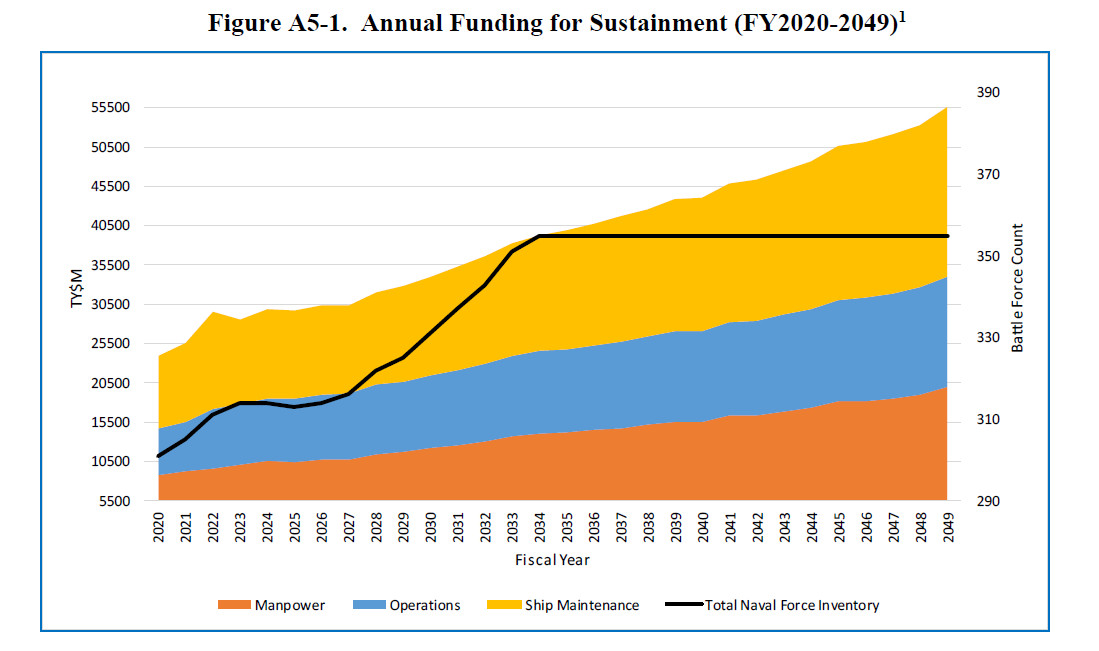

Even if the Navy does reach the 355-ship mark in the 2034 Fiscal Year, the service has noted that it will cost around $40 billion dollars just to operate and maintain those ships, a 34-percent increase over how much it spends to sustain its present fleets. That will grow to $55 billion over the next 15 years despite the service not planning to increase the total number of ships it has.

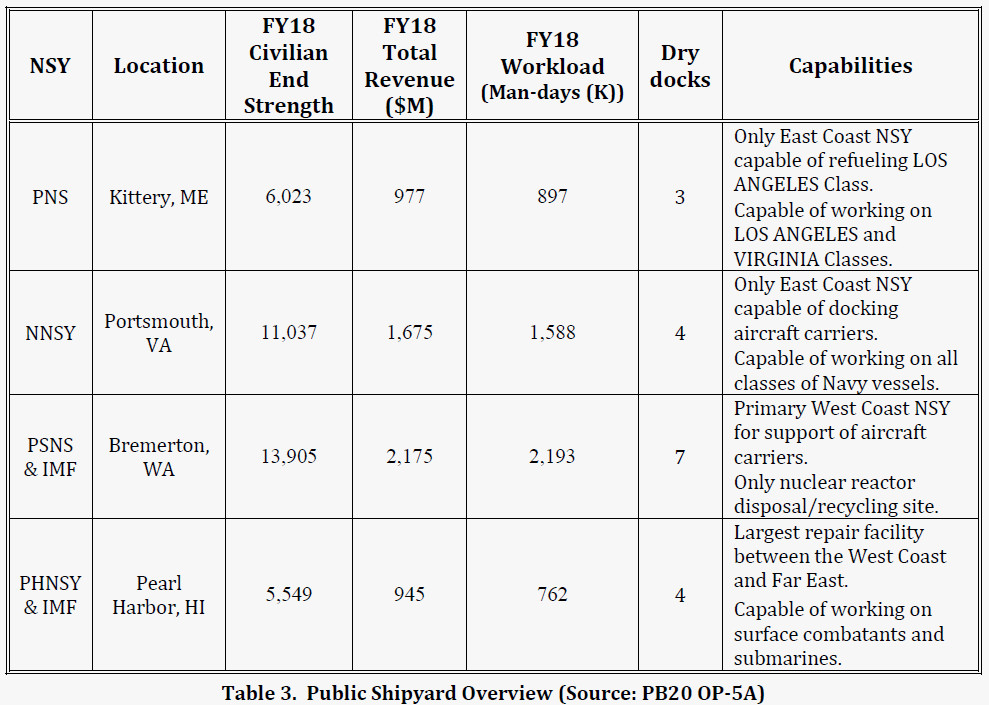

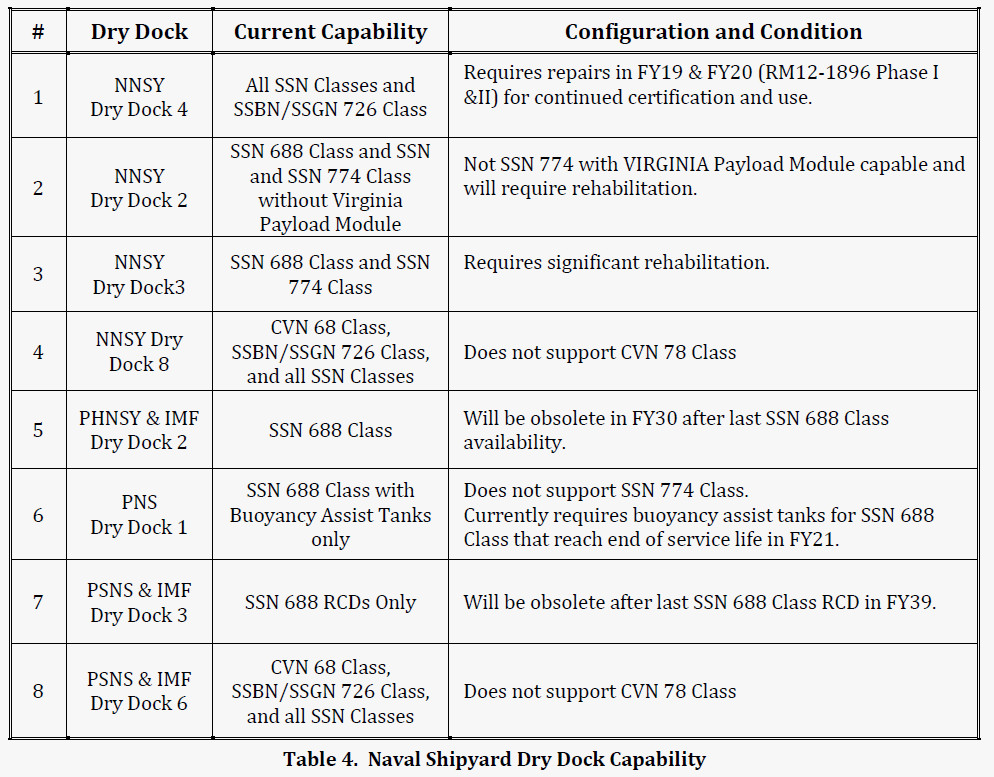

This doesn’t take into account the increasing difficulties the Navy is having in maintaining the ships and submarines it already has at the funding levels it has now. The day after it made the long-range shipbuilding plan publicly available, the service released its first ever long-range maintenance and modernization report, which highlight many of these ongoing issues, particularly the lack of dry dock capacity, both organically and immediately available in the private sector.

The Navy itself has just four shipyards still in operation, all of which are in need of major upgrades and rehabilitation to support both existing ships and those the service expects to purchase in the future. Efforts to shift some of that burden to certified private companies has been ad hoc and has often lengthened the time and cost of the entire process since these shipyards need to go through a contracting process in each case and then go about hiring additional workers and setting up supply chains to support the work.

“We must avoid feast and famine cycles that erode both the repair industrial base and the underlying vendor supply base,” the long-term maintenance and modernization report explains. “Consistent funding matched to steady demand for work will enable the repair base, public and private, to grow to meet the needs of the 355-ship Navy.”

The Navy credits “stable, on-time funding” on multiple occasions in its new long-term shipbuilding plan for providing this pathway to not only hit 355 ships, but do so two decades ahead of its previous plan. It’s certainly true that the significant increases in defense spending under President Donald Trump’s administration will help sustain the general growth the Navy is seeing now as the result of purchases made under President Barack Obama.

By the same token, however, any suggestion that defense budgets might contract or that it might not be possible to sustain major increases in spending in the next decade or two, could force the Navy to once again reassess its future dramatically. Congressional intervention on specific items, such as a push to save the Truman or a decision to add in additional ships that don’t fit within the overall plan, could have cascading impacts that might alter the overall schedule.

“The reason @USNavy will hit 300 ships (& 308 in ’21) is bc [sic; because] of ships I built in [the] @BarackObama Admin,” former Secretary of the Navy Ray Mabus Tweeted out on Mar. 13, 2019. “Takes a long time to build & even longer to rebuild a shrinking fleet. Unless this admin keeps building at my pace, fleet will shrink again.”

There is always the possibility for dramatic shifts in defense policy and national interests, as well, that could set the tone going forward or even call into question the goal of a 355-ship Navy. Whether or not President Trump wins another term in 2020, the Navy has at least two more Presidents and many more Congresses to look forward to before it reaches its desired force size.

Recruiting and retaining the people necessary to man and support these ships is also in question. The Navy is in the midst of a personnel shortage now, before adding more than 50 new ships to its force structure, and it expects to face recruiting challenges in the future.

“The shipbuilding plan realistically supports this dynamic environment and reflects the unwavering imperative to remain fiscally balanced,” the Navy declares in the annual report. “Accordingly, the plan’s most valuable feature is scalability, and by setting the conditions for an enduring industrial base as a top priority the Navy is postured to more aggressively grow the force with additional resources, or to responsibly shrink the force with fewer resources, assuming the steady profiles are sustained.”

That last part of the sentence – “assuming the steady profiles are sustained” – is the most important. The Navy has outlined a very ambitious roadmap to get it to the size it says it needs to be in order to confront the challenges and threats it faces now and will in the future. It’s also one that does not necessarily leave a lot of margin for delays, changes in priorities, drops in funding, or any other unforeseen issues.

The Navy has certainly charted a course to get to a 355-ship fleet in 15 years. Now, it will be up to the service, the Pentagon, and Congress to keep the ambitious plan moving at the pace it needs to succeed.

Contact the author: jtrevithickpr@gmail.com