Lockheed Martin no longer intends to pursue a contract to replace a portion of the U.S. Air Force’s aging KC-135 aerial refueling tanker fleet. The company had previously been pitching an Americanized version of Airbus’ popular A330 Multi-Role Tanker Transport to meet this requirement. It says it will now refocus its efforts on other opportunities, including a design to meet the Air Force’s demands for an advanced next-generation tanker.

The Maryland-headquartered defense giant announced it was pulling itself out of the running for what the Air Force currently refers to as the KC-135 Recapitalization program in a brief statement earlier today. Airbus will continue to offer an A330 MRTT-based tanker to service, according to Aviation Week.

Lockheed Martin first rolled out its A330 MRTT-derived proposal, known as the LMXT, in September 2021. This would have involved converting Airbus A330s into an Air Force-specific MRTT configuration at Lockheed Martin’s facility in Marietta, Georgia.

“We are transitioning Lockheed Martin’s LMXT team and resources to new opportunities and priority programs within Lockheed Martin, including development of aerial refueling solutions in support of the U.S. Air Force’s Next-Generation Air-Refueling System (NGAS) initiative,” the statement today says. “We remain committed to the accelerated delivery of advanced capabilities that strengthen the U.S. Air Force’s aerial refueling missions.”

There had already been many signs this decision was coming.

When Lockheed Martin first pitched the LMXT it was for a program then referred to as the Bridge Tanker, under which the Air Force expected to buy between 140 and 160 additional tankers, which be of an existing, production-ready design or derivative thereof. This would “bridge the gap” between the end of the service’s existing planned orders for Boeing KC-46A Pegasus tankers and an advanced future design.

However, the Air Force subsequently indicated that it might not hold a competition for the Bridge Tanker program at all, and would simply purchase more KC-46As through one or more sole-source contracts with Boeing. Some members of Congress had subsequently indicated their intention to fight this decision if it came.

Then, earlier this year, the Air Force announced that it was slashing planned purchases under what is now called the KC-135 Recapitalization program to just 75 aircraft. This move was also seen as effectively nixing plans for a competition. The service is now focusing more on what is referred to as the Next-Generation Air-Refueling System (NGAS), as planned family systems the requirements for which are still evolving.

The Air Force had 365 KC-135s, a fleet that is slowly being divested, and 82 KC-46s, as of March, according to inventory data accompanying the service’s proposed budget for the 2024 Fiscal Year. Under existing contracts, the Air Force is expected to acquire a total of 179 Pegasus tankers. The service is also in the process of retiring its entire fleet of KC-10s, of which it only purchased 60 of which to begin with. Between its presently planned purchases of KC-46s and the 75 additional aircraft set to come under the KC-135 Recapitalization effort, the service will not be able to replace its older tankers on a one-for-one basis.

A major factor in all of this is the Air Force’s view that current-generation tankers like the KC-46A and the LMXT will simply be too vulnerable to operate effectively in forward areas of the battlespace in a future high-end conflict, especially one against China. This is a reality The War Zone has been calling attention to for years.

The Air Force is now hoping to begin fielding at least one component of the NGAS family of systems, which will be more survivable, through a combination of stealth and/or other features, by 2040, if not earlier.

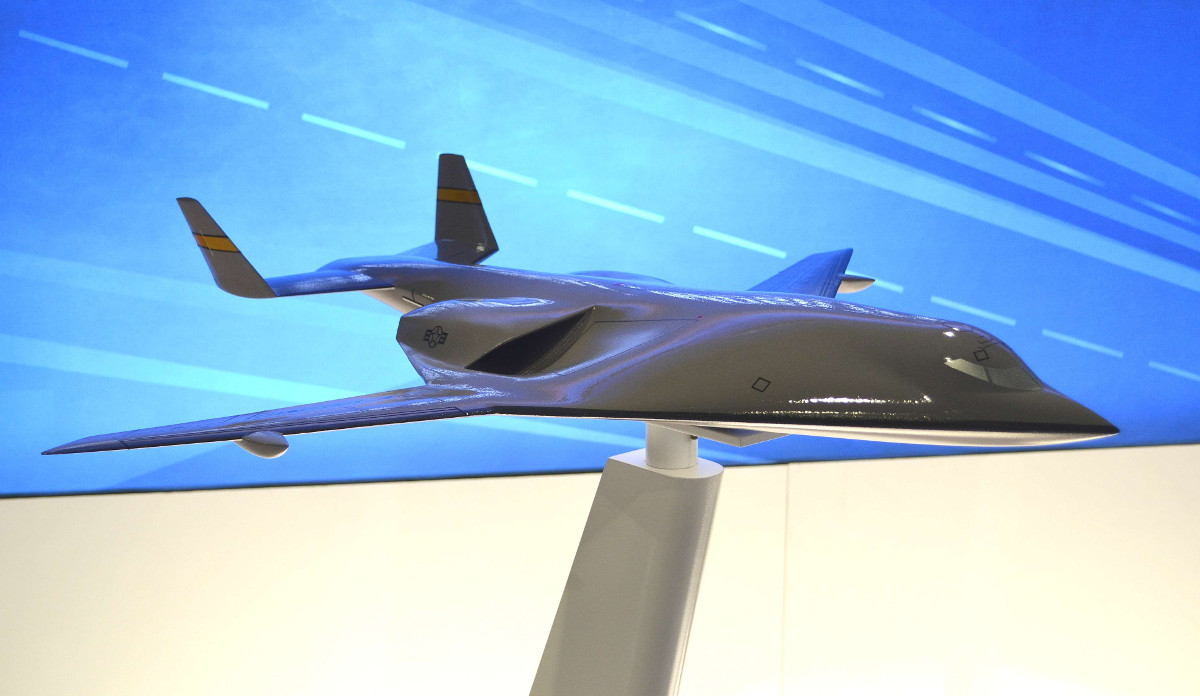

For years now, Lockheed Martin has been publicly showing a design concept for an at least somewhat stealthy next-generation tanker design using a so-called blended wing body platform. Blended wing bodies also typically offer high aerodynamic efficiency, and good fuel economy, as a result. This all, in turn, can give a design of this type greater range and payload capacity than a similarly sized, but more traditionally configured aircraft. These are capabilities that are also very much of interest to the Air Force in the context of a future high-end Pacific fight, which could be expected to occur across a broad area, much of it covered in water with no place for aircraft to land and refuel.

In fact, in August, the Air Force hired aviation startup JetZero, in cooperation with Northrop Grumman’s Scaled Composites, as part of a separate project, to build a full-size blended wing body demonstrator aircraft that could inform future tanker and airlifted designs. You can read more about this project here.

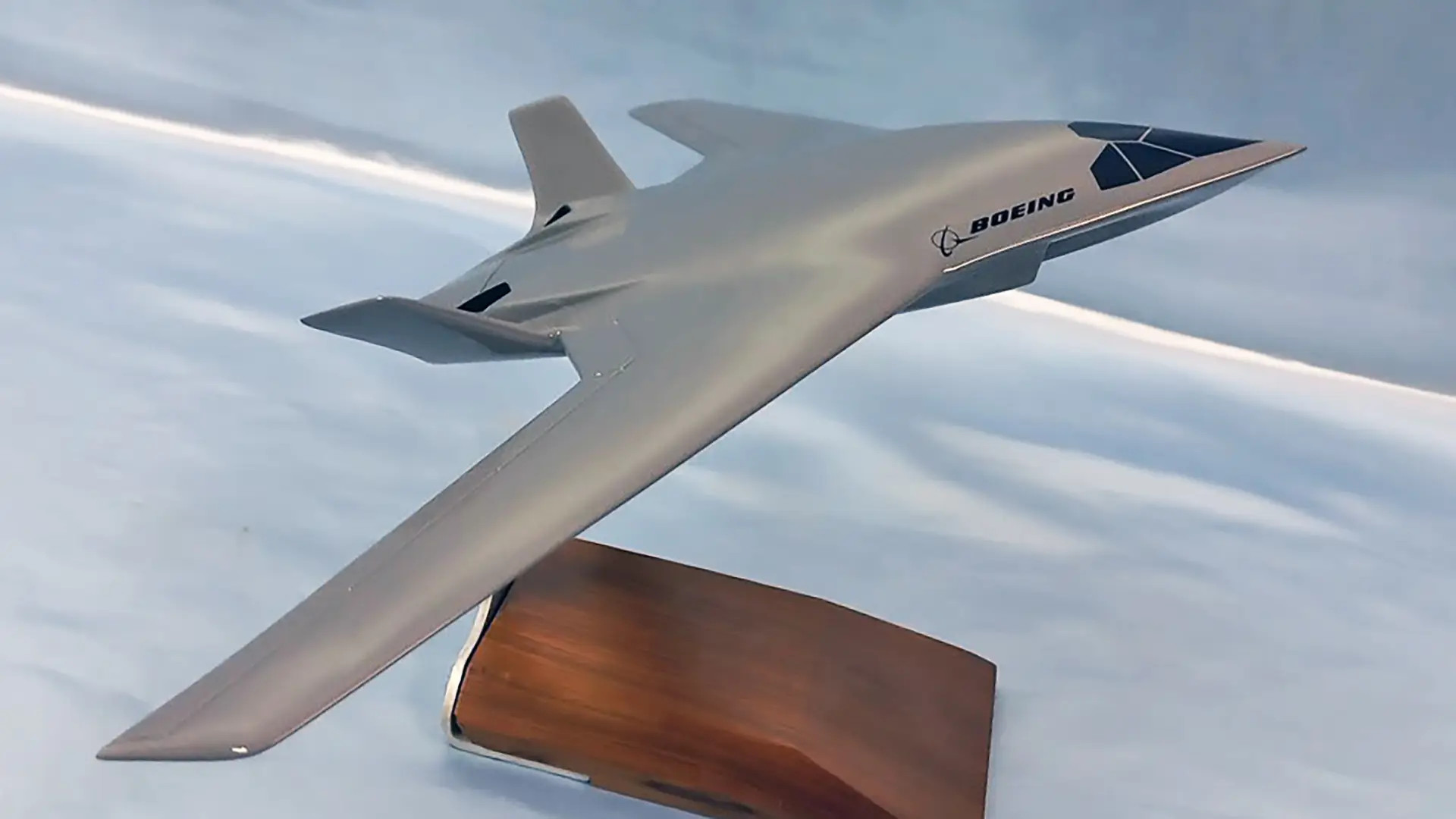

Boeing also unveiled a new blended wing body design concept, which it has presented first as a possible cargo carrier, but could also potentially serve as a tanker, in January.

Altogether, competition to build a new advanced tanker under NGAS already looks to be shaping up to be steep. As already noted, this program is being presented as a system of systems and could include other capabilities, including uncrewed aerial refueling platforms and podded aerial refueling booms that could transform existing aircraft into tankers as necessary.

If nothing else, Lockheed Martin’s decision to withdraw from the KC-135 Recapitalization competition marks the fourth time a pitch to the Air Force involving a version of the A330 MRTT has failed. Airbus lost three times previously, all while partnered with Northrop Grumman, to Boeing products, including what ultimately became the KC-46A. In the first instance, it was determined that the Air Force’s contracting process had been marred by serious corruption, which eventually landed the service’s top acquisition official at the time in federal prison.

“Any future tanking opportunities with Airbus will need to be considered based on specific requirements and timelines,” Stephanie Sonnenfeld Stinn, a Lockheed Martin spokesperson told The War Zone when asked about future cooperation with the European aviation conglomerate.

Back in 2019, even before rolling out LMXT, Lockheed Martin had said it was teaming up with Airbus to offer various aerial refueling capabilities to the U.S. military, possibly including contractor-owned and operated A330 MRTTs. In June of this year, Lockheed Martin confirmed it no longer intended to offer LMXT on a contract basis. It is, of course, possible that Lockheed Martin and Airbus could still collaborate in some way on an NGAS proposal.

Despite Airbus’ decision now to go it alone in an A330-based pitch to the Air Force, Lockheed Martin’s announcement today would seem to point to a growing likelihood that the Air Force will simply buy more KC-46As.

This is in spite of the Pegasus continuing to suffer from long-standing and serious technical issues, primarily with the Remote Vision System (RVS) that boom operators onboard use to link up with the receiving aircraft, as you can read more about here. Work on a new RVS is now not expected to be finished until October 2025, after which it will still need to be integrated onto all of the tankers that have already been delivered.

Boeing’s KC-46 line has also had quality control difficulties and other problems over the years. The company’s goal is to deliver 14 of these tankers to the Air Force this year, but has only turned over seven so far. This is in part due to another hold the U.S. military had placed on deliveries in August, which was blamed on bureaucratic contracting issues, and that was only lifted last week, according to Aviation Week.

All of this of course comes amid significant demand for aerial refueling capacity now and long-standing concerns from senior U.S. officials about potential tanker shortages. There have been reported discussions recently about the possibility of slowing KC-10 and KC-135 divestments to help mitigate these issues.

There has also been talk in the past about significantly expanding the use of contractor-owned and/or operated tankers to meet some non-combat aerial refueling demands and ease pressure on the Air Force’s fleets. In June, aviation firm Metrea became the first private contractor to refuel a U.S. Air Force aircraft. Metrea operates a fleet of four ex-Republic of Singapore Air Force KC-135s.

All told, it very much remains to see how the Air Force’s future aerial refueling tanker plans will continue to evolve. What is clear from Lockheed Martin’s announcement today is that its LMXT will not be a part of that future.

UPDATE 7:35 PM EST:

Airbus has now provided the following statement directly to The War Zone:

“Airbus remains committed to providing the U.S. Air Force and our warfighters with the most modern and capable tanker on the market and will formally respond to the United States Air Force KC-135 recapitalization RFI. The A330 U.S.-MRTT is a reliable choice for the U.S. Air Force: one that will deliver affordability, proven performance and unmatched capabilities.”

Contact the author: joe@thedrive.com