After years of praise for helping the Air Force fulfill a huge training gap at its most prestigious training installation — Nellis Air Force Base, the home of the USAF’s elite Weapons School, a large part of the Operational Test community, and the service’s massive Red Flag aerial wargames — Draken International’s permanent presence there will end in early June.

As it sits now, Nellis won’t execute an option to renew its adversary air (ADAIR) contract for another year with Draken International. The private adversary company, which is one of the largest in the fast-growing marketplace, flies a large mix of aircraft in the aggressor role from the base, including everything from straight-winged L-159 Honey Badgers to radar-equipped A-4 Skyhawks to supersonic Mirage F1s. Draken has been flying from Nellis since the dawn of the USAF’s private contractor aggressor initiative and the current contract for ADAIR operations at Nellis ends on June 4th, 2022, according to the company.

The move is a startling one that comes as peer-state competitors equipped with many types of aerial threats, and in great capacities, are dominating the Pentagon’s consciousness. Crowding the skies over the sprawling Nevada Test and Training Range (NTTR) with threats during huge exercises — augmenting the USAF’s higher-end organic adversary force — was just one aspect of what the ADAIR contract for Nellis was all about. Providing extra aggressor capacity for daily missions, including for testing and especially Weapons School activities, was and continues to be a focus of the program. As we understand it, even with the beefed-up 64th Aggressor Squadron, which has grown its F-16 inventory considerably, there is still a supply deficit for adversary air resources at Nellis today. So, eliminating this resource seems like a bizarre choice.

According to Christina Childs, the head of marketing and communications for Draken International, the Air Force told Draken it will not exercise the contract option with Draken because “Nellis customer capability demand signal” and “ACC [Air Combat Command] re-posturing our current contract execution to align with current industry capability.” Childs tells The War Zone that the Air Force has given no indication that it will even re-compete contract in the future, although that could possibly change.

It seems clear that Nellis wants higher-end capabilities than what is currently being made available by Draken’s fleet. This is not all that surprising. The migration to a more advanced, true 4th generation fighter capability equipped with datalinks, advanced radars, and things like infrared search and track systems has always been in the works. But the Air Force itself has stressed that it wanted to take a crawl-walk-run approach to ADAIR. These capabilities don’t just appear on-demand in a matter of months.

Fielding 4th generation fighters with the various upgrades to meet the Air Force’s future needs requires massive amounts of capital and time to acquire and deploy operationally. Even then, the price per hour will be significantly higher compared to lower-end older jets that are currently being used in ADAIR roles. How attractive that cost proposition is to the Air Force is yet to be seen. For instance, the Navy passed over F-16s for highly upgraded F-5s to support its advanced training activities at Naval Air Station Fallon in Nevada largely due to cost. Still, the elasticity of the contractor ADAIR arrangement offers huge benefits that go far beyond per flight hour cost.

ADAIR providers are quickly moving to more advanced platform choices to meet the Air Force’s emerging demand. Draken has surplus Dutch F-16AM/BMs arriving very soon, possibly by the end of the month, with many more being added throughout the year. More F-16s from Norway were in the process of being acquired, but The War Zone has learned that Norwegian authorities are pausing that effort due to the situation in Ukraine and the deteriorating security situation overall in Europe. That is not to say the deal is off, but second-hand F-16s are becoming a much hotter commodity, regardless.

One of Draken’s biggest competitors, Top Aces, already has a number of its ex-Israeli F-16A/Bs upgraded and flying from the firm’s base in Arizona that is dedicated to supporting the type. You can read all about Top Aces and their first-of-their kind F-16s in this recent War Zone feature. Even some F/A-18s could enter the ADAIR fray at some point. But it seems quite odd that Nellis would force a huge drop in aggressor capacity on itself instead of just executing the current option while it competes a contract for these higher-end capabilities to replace some or all of what it has at its disposal today. The fact that ACC is not even recompeting the contract at all, at least at this time, is even more shocking.

None of this impacts Draken’s many other training assignments under contract across the United States and around the globe. The firm is also competing to acquire the ADAIR training contracts for Luke Air Force Base in Arizona and Eglin Air Force Base in Florida, which are currently being fulfilled by ADAIR competitor ATAC. Internationally, the firm’s operations are rapidly expanding, not just in Europe, but in locales like the Middle East (Saudi Arabia), as well.

Still, the abrupt end to a permanent ADAIR presence at Nellis will send a chill through what is an extraordinarily capital-intensive and frankly, risky, business. Entire countries have trouble fielding the types of air forces the USAF may now demand of its contractors for certain mission sets. That is just the reality of the situation, and red tape, such as complying with International Traffic in Arms Regulations (ITAR) regulations for acquiring high-end military hardware is anything but a simple or quick process.

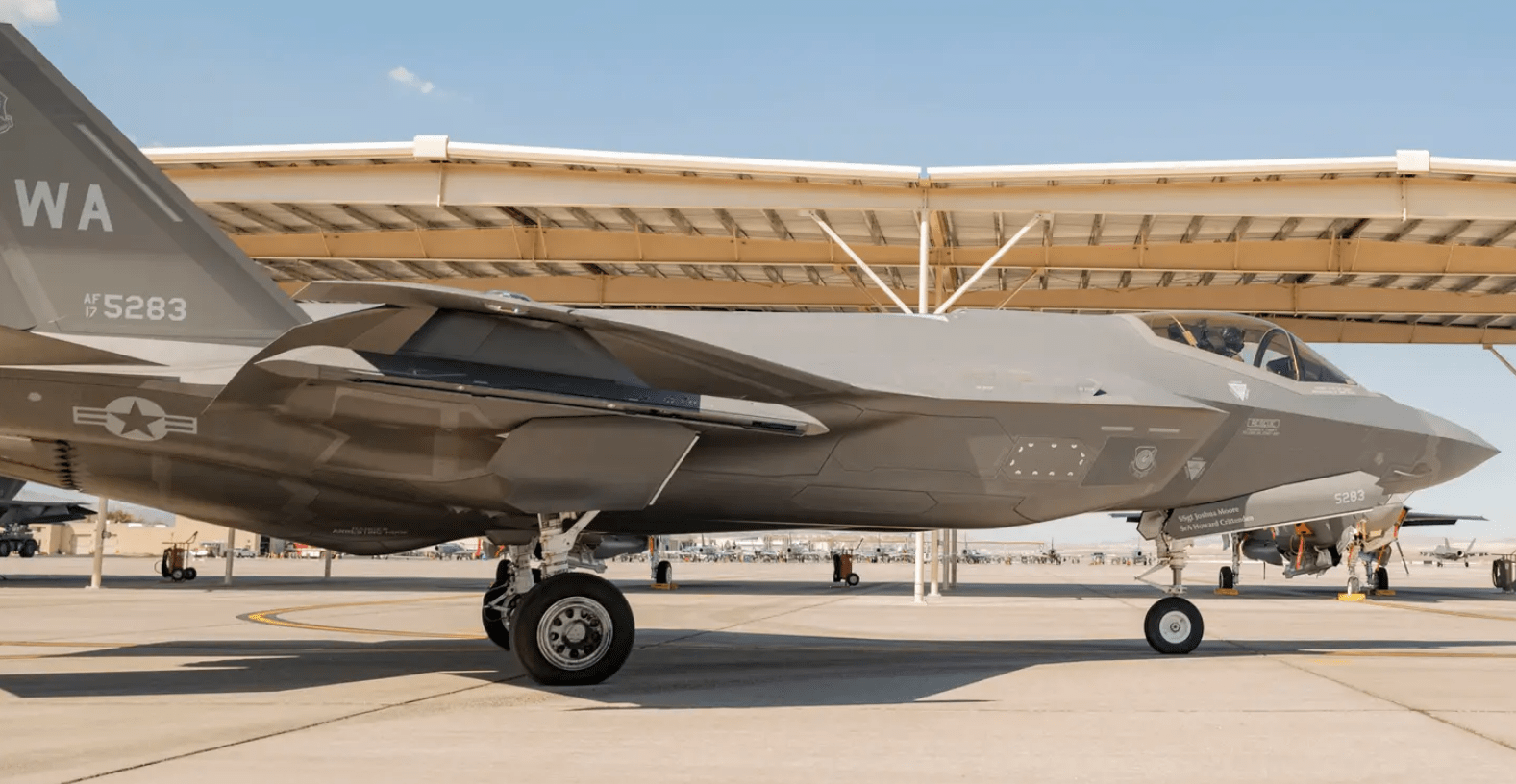

This all comes as the 64th Aggressor Squadron, which is the sole source of organic aggressor support at Nellis and generally the aggressor brain trust within the Air Force, has grown its ranks of aircraft with more F-16s on hand. F-35s are augmenting the unit, as well, to serve as a limited 5th generation adversary capacity. But its fleet of F-16s and a handful of the oldest F-35As will struggle to meet the massive demand for aggressors needed to challenge front-line aircrews flying aircraft with the latest sensor and missile technologies. Further augmenting the 64th AGRS’s capabilities with visiting units, especially those from the F-15C/D force which are masters in air-to-air combat, is one possibility.

The Eagles carry the most powerful AESA radar of any U.S. fighter, along with targeting pods for long-range air-to-air identification and now an operational IRST. The new F-15EX is only that much more potent. But these units, which are mostly Air National Guard, are already heavily taxed, and sending a handful of Eagles to Nellis to help with aggressor duties will not overcome the loss of an entire contractor’s deployed force at the base. In addition, these units already help support the Weapons School for ‘red air’ duties during peak periods. The USAF had an F-15C/D aggressor squadron, the 65th AGRS, that was shuttered due to sequestration. This was an incredibly short-sighted move at the time and is even more so in retrospect. As of late 2020, it was planned to reestablish that unit, with a mix of the aforementioned older F-35s and later-block F-16s, although it is not clear what the timeline for such an action is today or if the force will just stay consolidated within a larger 64th AGRS as it currently sits.

Other fighter units from the services could help pick up the slack, as well, but well-trained and dedicated aggressors — either private or government-furnished — are a different animal than having fleet units stand-in to help. Just moving these aircraft and their personnel to and from Nellis constantly year-round would cost massive amounts of money and tax other assets. And while there are emerging technologies that could offset some of this aggressor capacity one day, they are not available operationally today.

A great summary of how Nellis was planning on dealing with its great aggressor demand by integrating contractors was laid out by Lieutenant Colonel Jan ‘Kuts’ Stahl, who was then the deputy commander of the tenant 57th Operations Group at Nellis Air Force Base, in a War Zone feature on the state of the aggressors from December of 2020. It read in part:

“The combined, fielded, aggressor forces we have here at Nellis are barely able to fill 70 or so percent of what our optimal demand for adversary forces is. That’s what was leading the USAF to look at alternative courses of action such as contract aggressors, as well as inviting visiting units from elsewhere to come and help us out.”

“Because of the demands that you put on the adversaries here at Nellis, it was clear from the get-go that we weren’t going to be able to shut down a unit like the 65th and immediately replace it with something equivalent. The fielding of contract aggressor forces was always intended to be a multi-year process in which initially we put jets on the line to fill more of the demand for quantity as opposed to the demand for quality. We then put measures in place that over a period of multiple years to stimulate the contract adversary industry to put some of these specific requirements and demands that we need in order to meet that quality benchmark, as well.”

“At the moment I think we’re still in the early stages of that process, but there’s some really promising signs that — in the near future — we’re going to get some fairly significant capability increases from what the contractors are offering us. That’s going to take some of the strain off some of the USAF aggressors, which I would say are the ultimate low density, high demand assets that we have here.”

The USAF is ultimately looking to stimulate the red air contractors to gradually build to a point where they’re financially and operationally able to field airframes of higher and higher capability. “The Air Force was deliberate to not put all the eggs in one basket, and split the contracts up to see which of them was going to be more successful in continuing to ramp up the capabilities that they are able to field,” explains Stahl. “The contracts also break adversaries down into various capability levels, because what you need for a trainee flying their first couple of flights in say an F-16 is not the same as you need for an F-22 Weapons Officer.”

“The Air Force is offering a lower entry-level aggressor, which allows some companies to come in with a fairly low upfront investment to get into the contract and be able to generate revenue. Then they are gradually raising capabilities to levels that the company can progress into. Based on what we’ve heard here, there are a lot of companies out there that have some really exciting capabilities that they’re working on. They need to get their foot in the door and start making revenue, then starting making the investment.”

“The Weapons School is our central coordinating authority here, because they take up most of the aggressor demand at Nellis. They apportion who does what, who does the 64th AGRS support, who does Draken International support, or do we support together. Managing the contracts and ensuring the contractors meet those quality benchmarks is where the aggressors come in. We lead the missions that they are part of, and we also run the post-mission reviews of performance, and ensure they comply with demands and tactical learning points that we required them to provide.”

Exactly how the equation changed to the point that Nellis would not execute its option for the contract extension is puzzling, to say the least.

Although there have been three crashes of contractor Mirage F1 jets recently, one of which was out of Nellis and belonging to Draken, we have not seen any evidence this decision is related to any issues with those aircraft. Also, they are just a part of Draken’s force at Nellis at any given time.

We have reached out to Nellis AFB and Air Combat Command to get an idea of how this was rationalized. There could be a totally reasonable explanation we simply are not seeing at this time. But, as it sits, not executing the option for Draken’s services at Nellis, after it took years to get it to the operational capability it exists in today, seems like a very peculiar decision to make at a time when the basic need to put as many real targets in the air as possible for fighter pilots to deal with has never been more pressing.

Contact the author: Tyler@thedrive.com